Real Estate Report: January 2023

Local Residential Market Sales Sees Slower Than Usual Start to Year

KELOWNA, B.C. – February 6th, 2022.

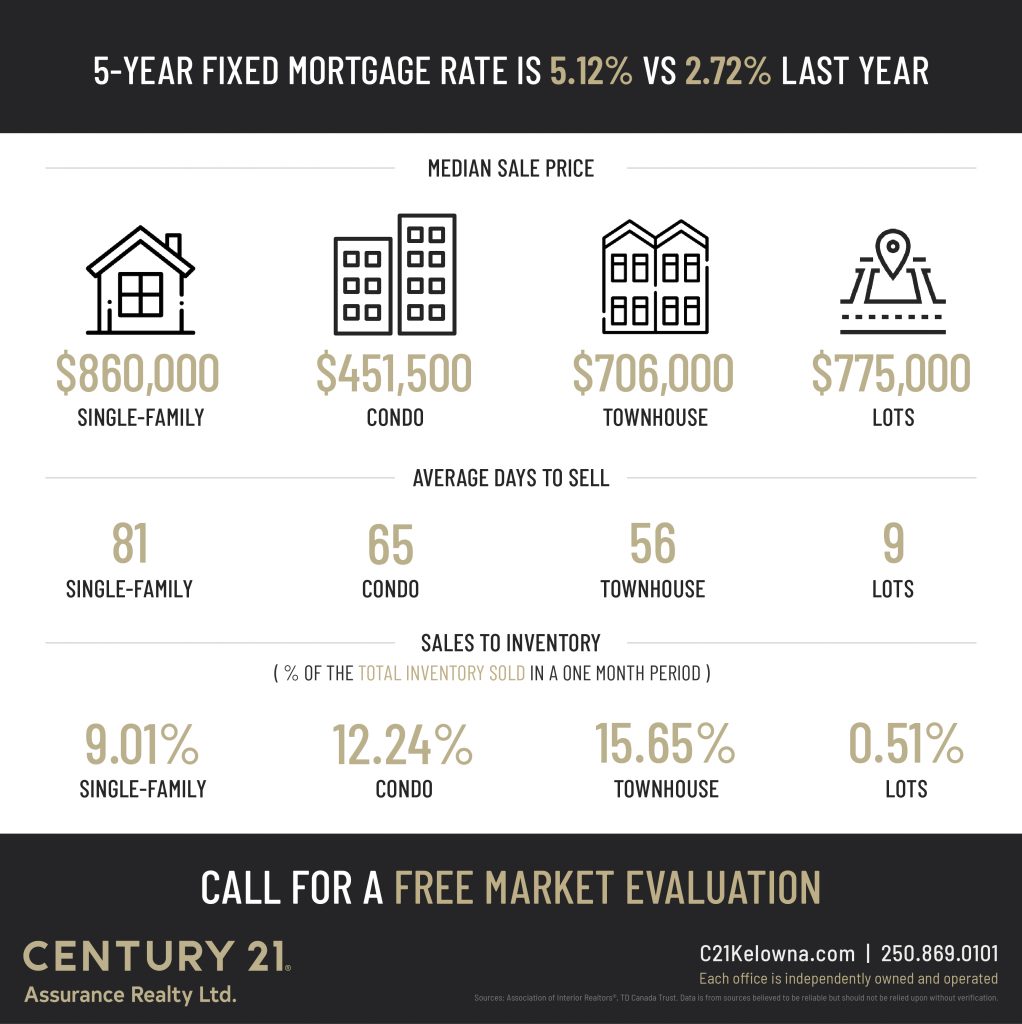

Residential real estate sales started the year off with nearly half as many sales activity compared to the same month the year prior, reports the Association of Interior REALTORS® (the Association).

A total of 552 residential unit sales were recorded across the Association region in January representing a 48.6% decrease in sales compared to the bustling market of January 2022.

“This dampening in sales activity is not unexpected given current market conditions. Specifically, the cost of borrowing has risen over the course of the year and weighs heavily on homebuyers’ plans,” says the Association of Interior REALTORS® President Lyndi Cruickshank, adding that “demand is still strong, but high interest rates will likely continue to make for a slow first quarter in real estate activity.”

New residential listings saw a slight uptick of 7.1% within the region compared to January 2022 with 1,430 new listings recorded. Overall inventory saw a healthy increase of 99.8% with 6,208 units currently on the market at the close of January.

“Despite an increase in inventory, there is still a lack of affordable housing which is compounded by the high interest rates,” notes Cruickshank, adding “we are seeing buyers and sellers holding off on their real estate intentions as their money just doesn’t get them as far as what it used to.”

The benchmark price for single-family homes in the Central Okanagan, North Okanagan, South Okanagan and Shuswap/Revelstoke regions all saw some modifications in year-over-year comparisons, with a mix of increases and decreases depending on the various home types. The benchmark price for single-family homes saw decreases across all areas compared to January 2022, with the highest percentage decrease in the Central Okanagan; down 7.9%, coming in at $976,800.

The average number of daysto sell a home, always a good barometer to watch, increased to 86 days compared to last month’s 75 days. It’s important to note that the average of days on market is for the entire Okanagan region and that the indicator will vary depending on home type and sub-region.

Given the high stakes on such a significant financial transaction, home sellers and buyers can benefit from the knowledge and skills of a practiced REALTOR®. Contact your local REALTOR® to find out more about the real estate market and how they can help you achieve your real estate goals.

The Association of Interior REALTORS® is a member-based professional organization serving approximately 2,600 REALTORS® who live and work in communities across the interior of British Columbia including the Okanagan Valley, Kamloops and Kootenay regions, as well as the South Peace River region.

The Association of Interior REALTORS® was formed on January 1, 2021, through the amalgamation of the Okanagan Mainline Real Estate Board and the South Okanagan Real Estate Board. The Association has since also amalgamated with the Kamloops & District Real Estate Association and the Kootenay Association of REALTORS®.

Contact your local REALTOR® to find out more about the real estate market

and how they can help you achieve your real estate goals.

Real Estate Report: December 2022

Local Residential Market Closes the Year at Slower Pace

KELOWNA, B.C. – January 5th, 2022.

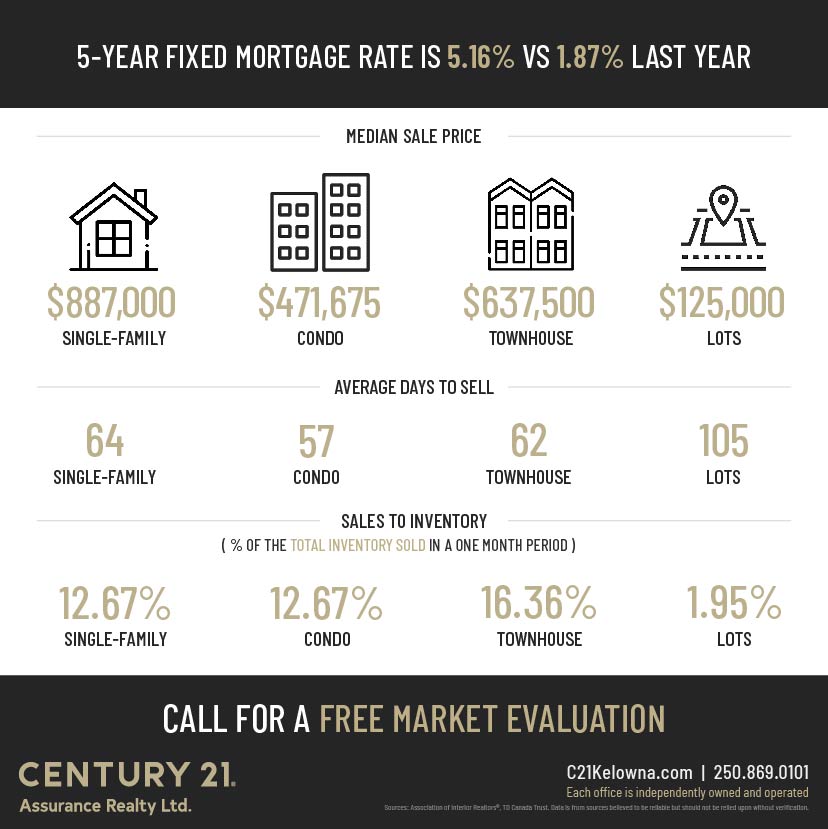

Residential real estate sales concluded 2022 with softened sales activity for the month of December, reports the Association of Interior REALTORS® (the Association).

A total of 572 residential unit sales were recorded across the Association region in December representing a 42.8% decrease in sales compared to the number of units sold during the unusually strong market of December 2021.

“After a very strong first half of 2022, we began to see market activity moderate amid consistently rising interest rates imposed by the Bank of Canada,” says the Association of Interior REALTORS® President Lyndi Cruickshank, adding that “although inventory levels remain tight, the high interest rates will continue to subdue market activity in the coming months.”

New residential listings saw a decline of 20.7% within the region compared to December 2021 with 651 new listings recorded. However, the overall inventory saw a 93.5% spike with 6,001 units currently on the market at the close of December 2022.

“Looking to 2023, we anticipate inventory will continue to accumulate, as compared to recent years, with all signs pointing to more balanced conditions with buyers and sellers benefitting equally,” notes Cruickshank, adding “real estate professionals will continue to support buyers and sellers as they navigate the real estate markets across the region.”

The benchmark price for single-family homes in the Central Okanagan, North Okanagan, South Okanagan and Shuswap/Revelstoke regions all saw moderate decreases in year-over-year comparisons. The benchmark price in all other housing categories saw minor to moderate increases compared to December 2021, with the highest percentage increase in the townhouse category for the North Okanagan; up 13.8% compared to December 2021, coming in at $574,400.

The average number of days to sell a home, always a good barometer to watch, increased to 75 days compared to last month’s 65 days. It’s important to note that the average of days on market is for the entire Okanagan region and that the indicator will vary depending on home type and sub-region.

Given the high stakes on such a significant financial transaction, home sellers and buyers can benefit from the knowledge and skills of a practiced REALTOR®. Contact your local REALTOR® to find out more about the real estate market and how they can help you achieve your real estate goals.

The Association of Interior REALTORS® is a member-based professional organization serving approximately 2,600 REALTORS® who live and work in communities across the interior of British Columbia including the Okanagan Valley, Kamloops and Kootenay regions, as well as the South Peace River region.

The Association of Interior REALTORS® was formed on January 1, 2021, through the amalgamation of the Okanagan Mainline Real Estate Board and the South Okanagan Real Estate Board. The Association has since also amalgamated with the Kamloops & District Real Estate Association and the Kootenay Association of REALTORS®.

Contact your local REALTOR® to find out more about the real estate market

and how they can help you achieve your real estate goals.

Real Estate Report: November 2022

Local Residential Market Cooling Down Heading into Holiday Season

KELOWNA, B.C. – December 5th, 2022.

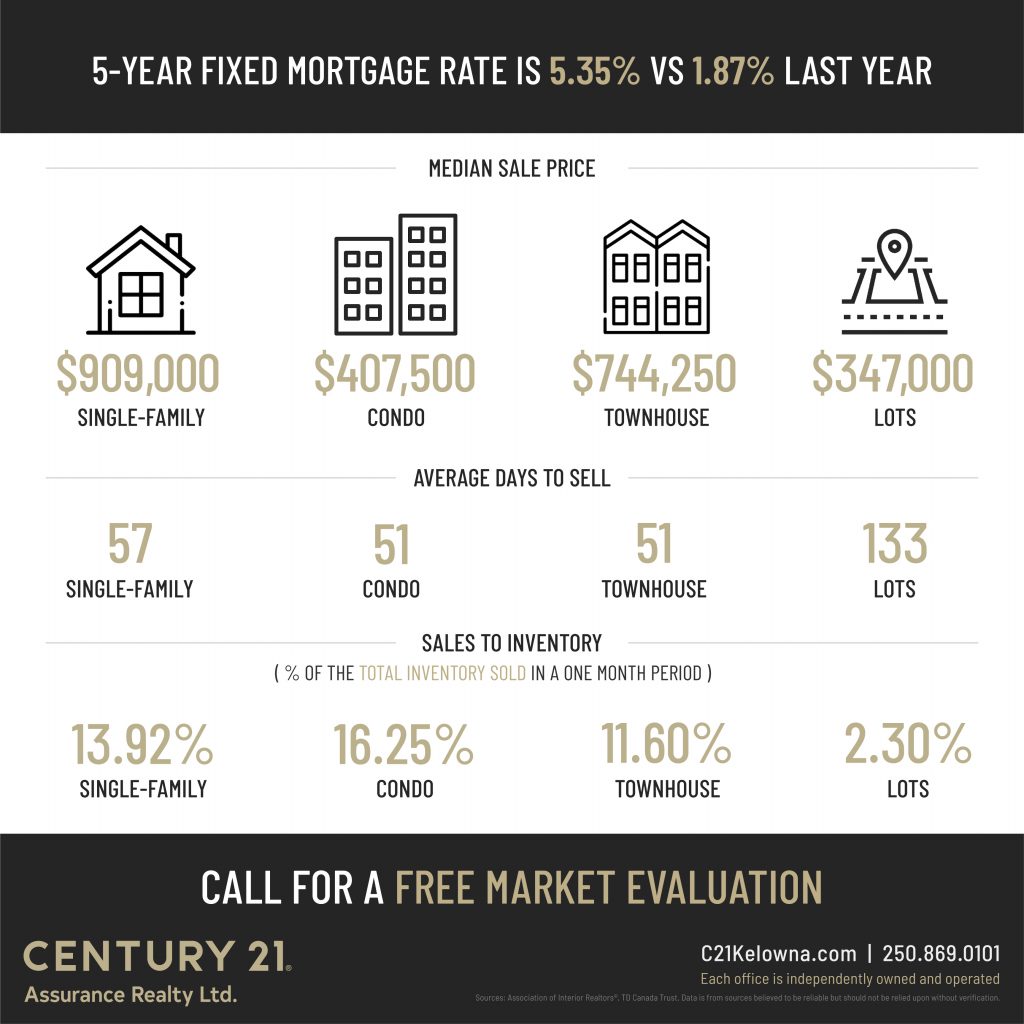

Residential real estate sales for the month of November in the region saw sales dip heading into the holiday season, reports the Association of Interior REALTORS® (the Association).

A total of 844 residential unit sales were recorded across the Association region in November representing a 48.4% decrease in sales compared to the number of units sold during the hyperactive market of November 2021, with a decrease of 15.6% compared to last month.

“Although the numbers seem far below what we have become accustomed to, comparing sales from this year to last year would be like comparing apples to oranges,” says the Association of Interior REALTORS® President Lyndi Cruickshank, adding that “comparing to a typical seasonal pre-pandemic November would represent a more accurate comparison over the frenzied market over the last few years, which would show that we are currently not that far off from an average November.”

New residential listings saw a moderate decline of 4.6% within the region compared to the same month last year with 1,357 new listings recorded. However, the overall inventory saw a healthy 85.3% boost over the availability in November 2021 with 6,980 units currently on the market; providing more options to buyers.

“While it’s great to see that the number of active listings is higher than it has been for a long time, the market remains tight as new inventory seems to be flattening,” notes Cruickshank, adding “this is not unusual for this time of year as sellers hold off on listing while they are enjoying the holiday season.”

The benchmark price for single-family homes in the Central Okanagan, North Okanagan and South Okanagan regions all saw increases in year-over-year comparisons, with the exception of the Shuswap/Revelstoke area that saw a 4.4% decrease in single-family benchmark prices. The benchmark price in all other housing categories saw minor to moderate increases compared to November 2022, with the highest percentage increase in the condominium category for the South Okanagan; up 16.4% compared to November 2021, coming in at $422,800.

The average number of days to sell a home, always a good barometer to watch, increased to 65 days compared to last month’s 64 days. It’s important to note that the average of days on market is for the entire Okanagan region and that the indicator will vary depending on home type and sub-region.

Given the high stakes on such a significant financial transaction, home sellers and buyers can benefit from the knowledge and skills of a practiced REALTOR®. Contact your local REALTOR® to find out more about the real estate market and how they can help you achieve your real estate goals.

The Association of Interior REALTORS® is a member-based professional organization serving approximately 2,600 REALTORS® who live and work in communities across the interior of British Columbia including the Okanagan Valley, Kamloops and Kootenay regions, as well as the South Peace River region.

The Association of Interior REALTORS® was formed on January 1, 2021, through the amalgamation of the Okanagan Mainline Real Estate Board and the South Okanagan Real Estate Board. The Association has since also amalgamated with the Kamloops & District Real Estate Association and the Kootenay Association of REALTORS®.

Contact your local REALTOR® to find out more about the real estate market

and how they can help you achieve your real estate goals.

Real Estate Report: October 2022

Local Residential Market Inventory Slowly Building Back Up

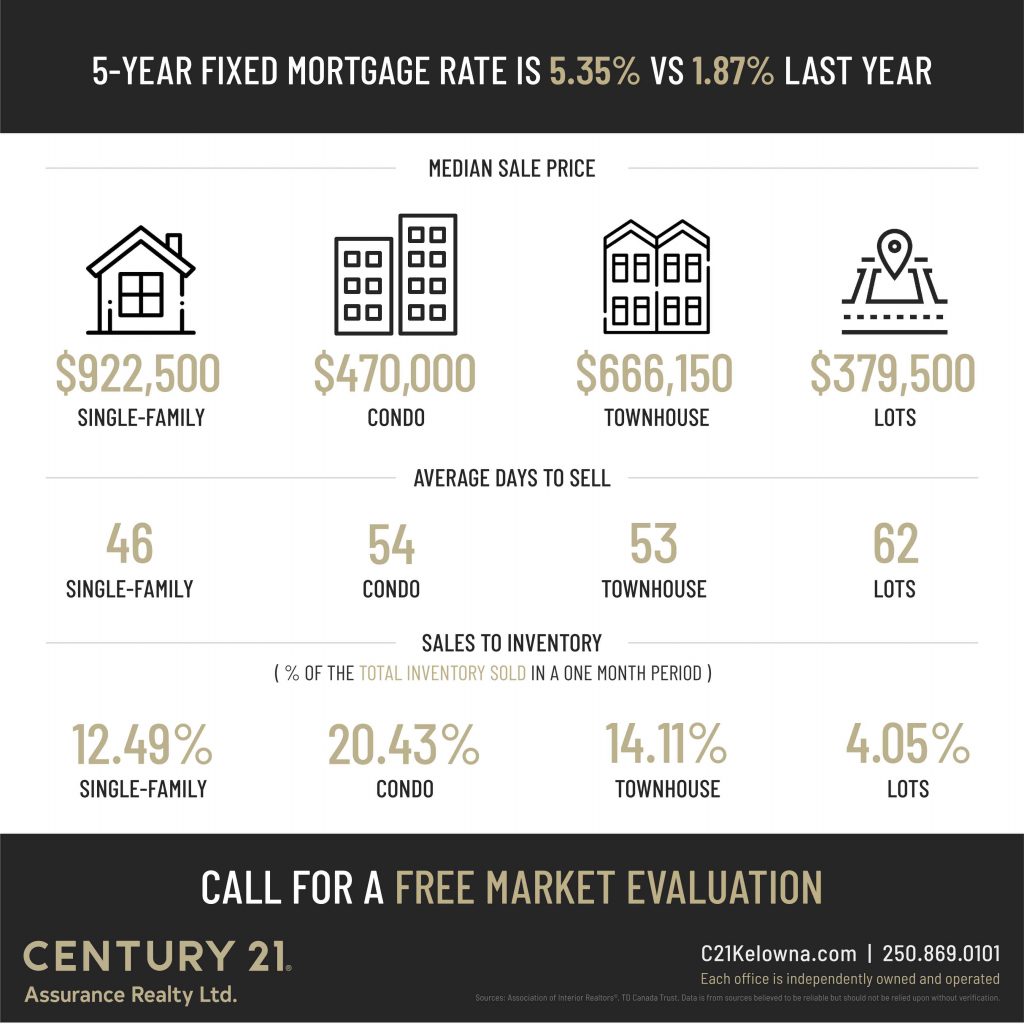

KELOWNA, B.C. – November 4th, 2022. Residential real estate sales for the month of October in the region saw an increase in inventory while sales held steady, reports the Association of Interior REALTORS® (the Association).

A total of 1,001 residential unit sales were recorded across the Association region in October representing a 43.8% drop in sales compared to the number of units sold during the seasonally uncommon strong market of October 2021; dipping only 7.6% compared to last month.

“Unlike the last two years or so where we saw buyers’ and sellers’ expectations drastically unaligned from each other, a shift from the frenzy earlier this year coupled with the winter seasonal slowdown is bringing some equilibrium to the market amidst rising interest rates,” says the Association of Interior REALTORS® President Lyndi Cruickshank, adding “motivated buyers’ and sellers’ expectations are able to come closer together, resulting in a much more positive home buying and selling experience.”

New residential listings saw a decrease of 9.8% within the region compared to the same month last year with 1,689 new listings recorded. However, the overall inventory provides more options to buyers with a 67.5% increase over the availability in October 2021 with 7,450 units currently on the market.

“It’s nice to see active listings starting to build back up again,” notes Cruickshank, adding “however, we are not quite out of what is considered a seller’s market and into a balanced market.”

The Benchmark Price for homes in the Central Okanagan, North Okanagan and South Okanagan regions saw increases in year-over-year comparisons across all home categories, while the Shuswap/Revelstoke region was the exception showing a decrease in the single-family home category while seeing increases in townhome and condominium benchmark prices. The benchmark price for single-family homes in the Shuswap/Revelstoke lessened 4.1% compared to October 2022, coming in at $673,300.

The average number of days to sell a home, always a good barometer to watch, increased to 64 days compared to last month’s 50 days. It’s important to note that the average of days on market is for the entire Okanagan region and that the indicator will vary depending on home type and sub-region.

Given the high stakes on such a significant financial transaction, home sellers and buyers can benefit from the knowledge and skills of a practiced REALTOR®. Contact your local REALTOR® to find out more about the real estate market and how they can help you achieve your real estate goals.

Contact your local REALTOR® to find out more about the real estate market

and how they can help you achieve your real estate goals.

Real Estate Report: March 2022

Residential Real Estate Market Heading Into Seasonally Busy Spring Fling

Residential real estate sales for the month of March saw a slight uptick over February sales showing signs that the typically busy spring market has commenced in the region, reports the Association of Interior REALTORS®.

A total of 1,898 residential unit sales were recorded across the Association region, marking a 25% decrease compared to a record-high number of units sold in March 2021. New residential listings coming onto market in March saw a decrease of 7% within the region with 2,871 new listings recorded compared to the same period last year yet increased 55% compared to last month’s 1,850. The overall active listings clocked in marginally below last year March’s active listings with 4,018 listings that is a nearly 3% decrease in year-over-year comparisons.

“It is encouraging to see that in the month of March we saw a slight increase of sales, as well as an upswing of new listings compared to February, which is seasonally expected for the local real estate market as we head into the warmer spring months,” says the Association of Interior REALTORS® President Kim Heizmann, adding that “the spring fling seems to have been kick-started which is great news for buyers and sellers, however, new listings are still not coming on to the market at the rate needed to meet demand.”

“Without a drastic supply of housing coming onto market, the lack of inventory will continue to impact buyers and sellers in the coming months,” noted Heizmann.

The benchmark price for homes in the Central Okanagan, North Okanagan, South Okanagan, and Shuswap/Revelstoke regions had double-digit percentage increases in year-over-year comparisons for another consecutive month across all home categories, with the greatest increase being for single-family homes in the South Okanagan. The benchmark price for single-family homes in the South Okanagan recorded a 37.6% increase compared to March 2021 coming in at $731,400.

The average number of days to sell a home, always a good barometer to watch, dropped down to 46 days from 54 days last month. It’s important to note that the average of days on market is for the entire Okanagan region and that the indicator will vary depending on home type and sub-region.

Contact your local REALTOR® to find out more about the real estate market

and how they can help you achieve your real estate goals.

Real Estate Report: February 2022

Lack of Supply Continues to Drive the Residential Real Estate Market

Residential real estate demand across the Association region remains strong heading into the seasonally busy spring months despite a persistent lack of inventory in the region and throughout the province, reports the Association of Interior REALTORS®.

A total of 1,516 residential unit sales were recorded across the Association region, marking a 15% decrease compared to a record-high number of units sold in February 2021. New residential listings coming onto market saw a decrease of 12% within the region with 1,850 new listings recorded. The overall active listings were also far below last year’s February active listings showing a 19% decrease in year-over-year comparisons.

“The persistent lack of new listings coming onto market is far from adequate to meet the demand of buyers locally and those coming from other markets,” says the Association of Interior REALTORS® President Kim Heizmann, adding that “we are seeing the mismatch of inventory versus demand taking a toll on buyers as they show signs of fatigue in having to compete in a seller’s market where lack of supply is putting upward pressure on pricing, and further on affordability.”

In the South Peace River region, there was a total of 38 residential unit sales recorded in February, with 229 overall active listings, a decrease of 26% compared to the same time last year. The average price for single-family homes and apartments both saw increases in year-over-year comparisons, coming in at $267,712 and $41,333 respectively, while the average price for mobile homes declined 9% to rest at $37,750 in the same period.

“The lack of housing supply continues to be the key driver of real estate market performance with homebuyers and sellers having to navigate through a high demand and low supply situation,” noted Heizmann.

“Instead of looking for quick fixes to dampen housing demand, government policies should focus on measures that could bring more housing to the market, as outlined in BCREA’s recent white paper – A Better Way Home. Providing more options for buyers can help soften competitive market conditions and provide much-needed inventory after months of supply drought,” says Heizmann.

The average number of days to sell a home, always a good barometer to watch dropped down to 54 days. It’s important to note that the average of days on market is for the entire Association region and that the indicator will vary depending on home type and sub-region.

Contact your local REALTOR® to find out more about the real estate market

and how they can help you achieve your real estate goals.

Real Estate Report: January 2022

Active Listings Remain At All Time Low For Local Real Estate Market

Real estate professionals continue to support buyers and sellers in navigating the lack of inventory in residential real estate markets across the region from Revelstoke to Eastgate Manning Park and into the South Peace River region, reports the Association of Interior REALTORS®.

Residential sales for the entire Association region for January 2022 saw a 10% decrease compared to the same month last year with 701 units sold this month and 782 units sold in January 2021.

“The persistent lack of inventory on market makes for challenging times for buyers and sellers,” says the Association of Interior REALTORS® President Kim Heizmann, adding that “not only are new buyers frustrated at finding a home but sellers are frustrated at the lack of active supply hindering their ability to move on to a new property as well.”

“The value of working with a professional real estate agent really does make a difference in navigating the complicated buying and selling process, under any circumstances, but especially during these challenging conditions,” says Heizmann.

The supply of active residential listings dipped 38% across the Association region compared to the 2,787 active listings in January 2021 coming in at 1,721 this year. New listings also saw a downtick with 824 new listings for January 2022, compared to 1,094 units during the same month last year.

The benchmark price for homes in the Central Okanagan, North Okanagan, South Okanagan, and Shuswap/Revelstoke regions continued their upward double-digit percentage increases in year-over-year comparisons for another consecutive month across all home categories.

In the South Peace River Region, where benchmark pricing is not available, the average price for single-family homes hit double-digit increases while inventory in the same category saw a double-digit decrease of 43% in year-over-year comparisons.

Contact your local REALTOR® to find out more about the real estate market

and how they can help you achieve your real estate goals.

Choose The Gold Standard in Real Estate

Selling or Buying real estate is competitive! It might surprise you to learn that Century 21 Assurance Realty Ltd. in Kelowna is not the largest real estate office in the Okanagan. Yet, you see our signs everywhere! That’s because our team of unique, highly skilled, and fun agents produce results. Agent for agent, our top producers beat out the competition in sales volume and customer satisfaction, year after year*.

Backed by the advanced technology of Elevate21, our team of Realtors are specialists in the Okanagan with hundreds of years of marketing, negotiation, and communication experience. It’s our team approach that works.

If you’re looking to join a high-performing brokerage, choose the Gold Standard in Real Estate… we have time for you!

*CENTURION Award* is given to the top 6% of agents across Canada. 29 agents or 36% of Century 21 Assurance Realty Ltd. agents achieved this mark in 2021.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link